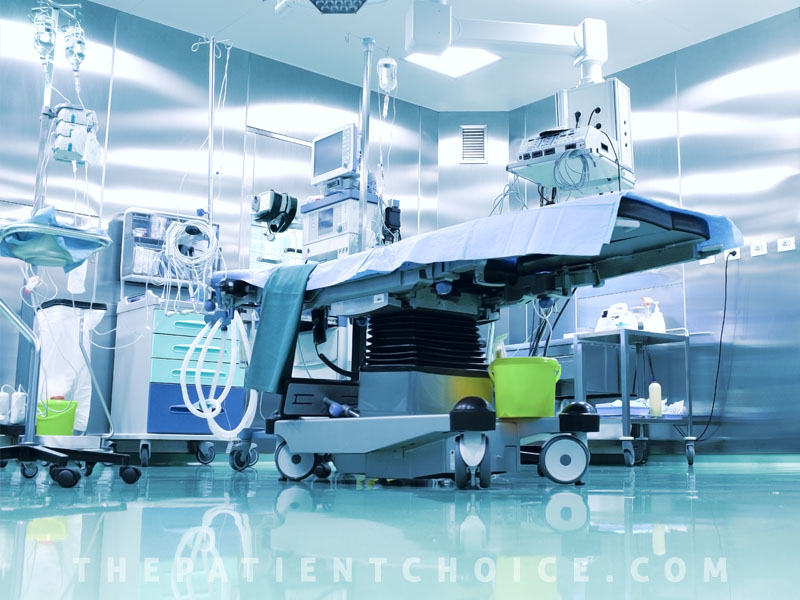

What are Long-Term Care Hospitals?

Most people who need inpatient hospital services are admitted to an “acute care” hospital for a relatively short stay. But some people may need a longer hospital stay. Long-term care hospitals (LTCHs) are certified as acute care hospitals, but LTCHs focus on patients who, on average, stay more than 25 days. Many of the patients in LTCHs are transfered there from an intensive or critical care unit. LTCHs specialize in treating patients who may have more than one serious condition, but who may improve with time and care, and return home. Services provided in LTCHs typically include comprehensive rehabilitation, respiratory therapy, head trauma treatment, and pain management.

Is this the kind of care that long-term care hospitals give? No. Long-term care usually refers to care that’s basically custodial (like help with feeding or dressing), even if there’s some health care given. Medicare doesn’t cover this kind of care, which can be given in your own home or in various kinds of facilities (like assisted living facilities). LTCHs are hospitals that give inpatient services to people who need a much longer stay to get well.

Do I pay more in a LTCH than in an acute care hospital?

Generally, no. Under Medicare, you’re only responsible for one deductible for any benefit period. A benefit period begins the day you’re admitted to a hospital or skilled nursing facility (SNF), and ends when you haven’t gotten any inpatient care in a hospital or SNF for 60 days in a row. This applies whether you’re in an acute care hospital or a LTCH.

You don’t have to pay a second deductible for your care in a LTCH if:

- You’re transferred to a LTCH directly from an acute care hospital.

- You’re admitted to a LTCH within 60 days of being discharged from an inpatient hospital stay.

On the other hand, if you’re admitted directly to the LTCH more than 60 days after any previous hospital stay, you would pay the same deductibles and coinsurance as you would if you were being admitted to an acute care hospital.

Note: If you have Original Medicare and a Medicare Supplement Insurance policy (Medigap), some of your deductible or coinsurance costs may be covered. If you have a Medicare Advantage Plan (like an HMO or PPO), you may have different ways to pay for care, so you should contact your plan for more information.